Bancolombia's (CIB) alluring 8.64% dividend yield presents a compelling investment opportunity, but its equally striking 229.06% payout ratio raises serious questions about sustainability. This analysis dives deep into CIB's dividend history, examining the interplay of financial performance, macroeconomic factors, and regulatory considerations to assess the long-term viability of its generous payouts and help investors make informed decisions. Understanding this complex picture is crucial for navigating the potential rewards and inherent risks.

CIB Dividend History: A Decade of Payments

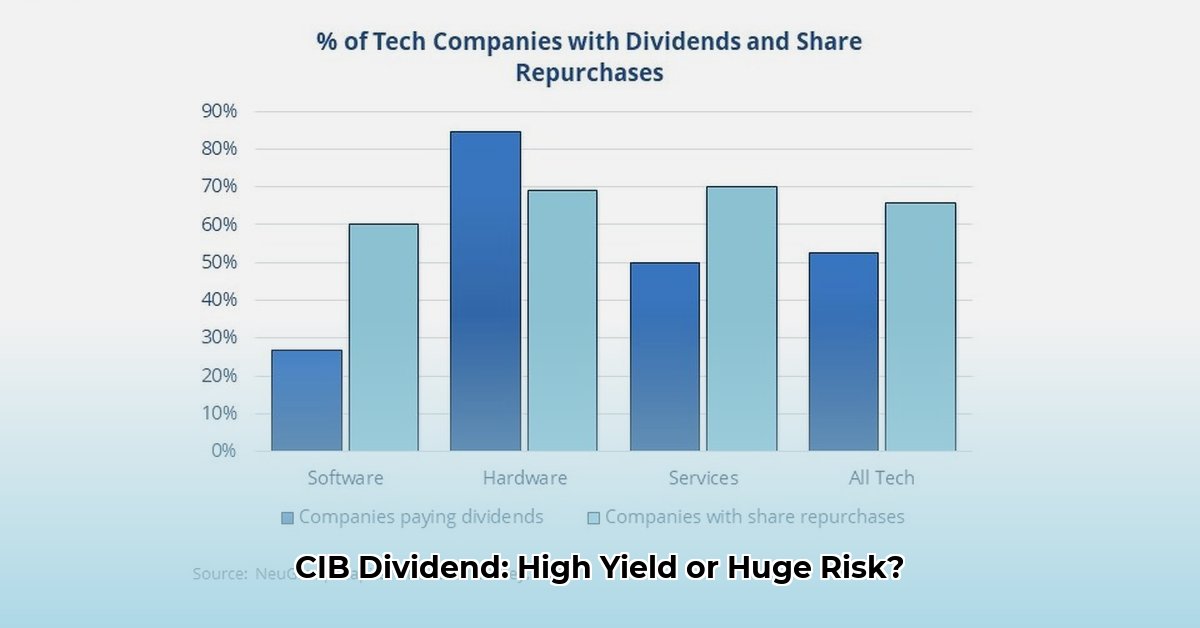

Over the past decade, CIB's dividend payments per share have fluctuated significantly, ranging from a low of approximately $0.0661 to a high of roughly $0.91253. While the last three years have shown a modest annual increase of around 2.87%, this growth is dwarfed by the alarmingly high payout ratio. This discrepancy raises critical questions about the long-term health of CIB's dividend policy and its ability to sustain these payments without impacting growth or financial stability. The absence of share buybacks further emphasizes the company's heavy reliance on dividend payouts, adding to the concerns. Is this a sustainable strategy?

High Yield, High Payout: Unpacking the Numbers

The headline-grabbing dividend yield masks a crucial detail: CIB's payout ratio significantly exceeds 100%, implying that dividends exceed earnings. This is a major red flag, suggesting a potentially unsustainable financial model. Such a high payout ratio may signal financial weakness, especially during economic downturns. While the consistent quarterly payments are attractive, the fundamental imbalance between payout and earnings demands a deeper investigation. How long can CIB maintain this trajectory without compromising its financial health or future investment opportunities?

Geopolitical and Economic Factors: Colombian Context

CIB's fortunes are inextricably linked to the Colombian economy. Political instability, fluctuating commodity prices (Colombia is a major exporter of coffee, among other goods), and shifts in interest rates significantly impact profitability. For instance, a downturn in coffee prices, a key Colombian export, could trigger a ripple effect, potentially shrinking Bancolombia's earnings and jeopardizing its ability to maintain dividend payouts. Similarly, periods of political uncertainty can discourage investment and dampen economic growth, indirectly impacting the bank's financial performance. These macroeconomic factors introduce an element of unpredictability that requires careful consideration.

Regulatory Implications: Colombian and International Standards

CIB operates under the purview of Colombian regulations, which dictate dividend distribution and financial reporting requirements. These regulations, designed to promote transparency and protect investors, impact the bank's strategy. Changes in these rules or the adoption of new international standards could alter CIB's dividend policy, influencing future payouts. Understanding the regulatory landscape is crucial for accurately assessing risk and predicting potential changes.

Analyzing the Risks: Key Considerations for Investors

The high yield is a powerful incentive, but the unsustainable payout ratio and lack of share repurchases introduce significant risks. Investors need a diversified strategy and thorough due diligence to navigate these risks effectively.

Key Takeaways:

- High Payout Ratio: The unsustainable payout ratio is a major concern requiring close monitoring.

- Economic Dependence: CIB's performance significantly depends on the Colombian economy's health.

- Regulatory Uncertainty: Changes in Colombian and international regulations could impact future dividends.

Investor Strategies: Navigating the CIB Landscape

The optimal investment approach depends entirely on individual risk tolerance and goals.

Short-Term (0-1 Year): Closely monitor the payout ratio for any drastic changes; consider diversifying to reduce dependence on CIB; explore lower-risk alternatives if the payout ratio remains high.

Long-Term (3-5 Years): Conduct a thorough financial statement review to evaluate overall health and long-term growth potential; regularly reassess the investment based on CIB's ongoing profitability and the Colombian economic situation.

Institutional Investors: Engage directly with CIB management; conduct macroeconomic impact analyses; perform thorough ESG (Environmental, Social, and Governance) assessments; manage exposure appropriately.